Boi Reporting 2025 Website Boi

Boi Reporting 2025 Website Boi. Any reporting company created or registered to do business before january 1, 2025, will have until january 1,. Entities created on or after january 1, 2025, will have 30 days to report their boi.

Entities created on or after january 1, 2025, will have 30 days to report their boi. Beginning january 1, 2025, certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial owners—the persons who ultimately own or control the company—to the department of the treasury’s financial crimes.

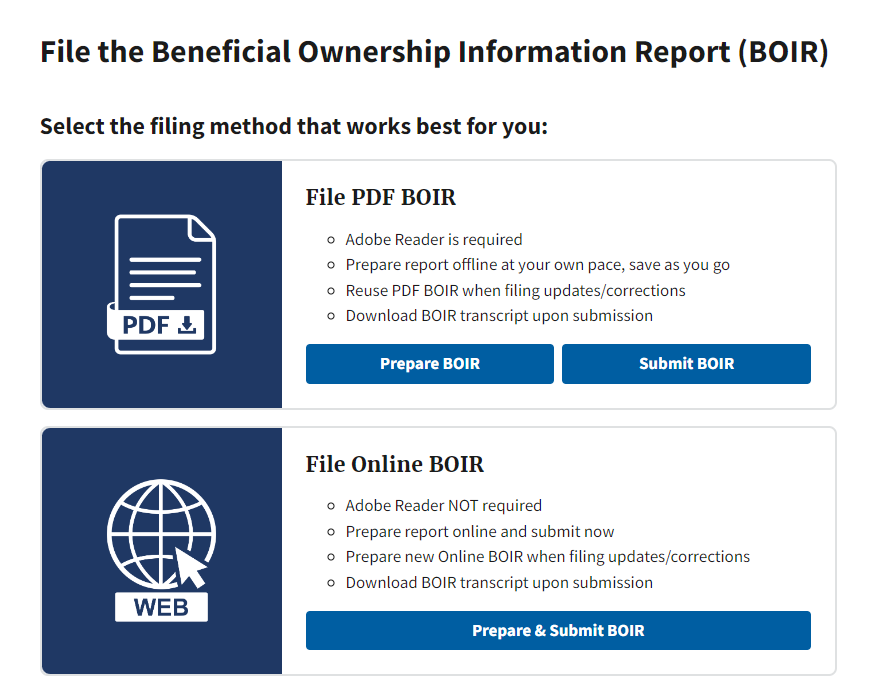

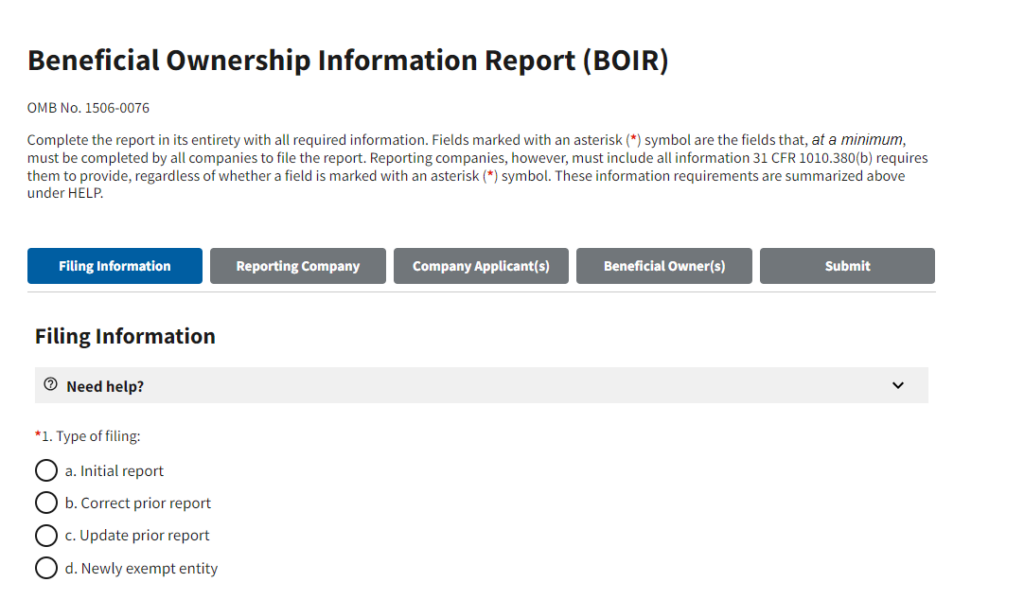

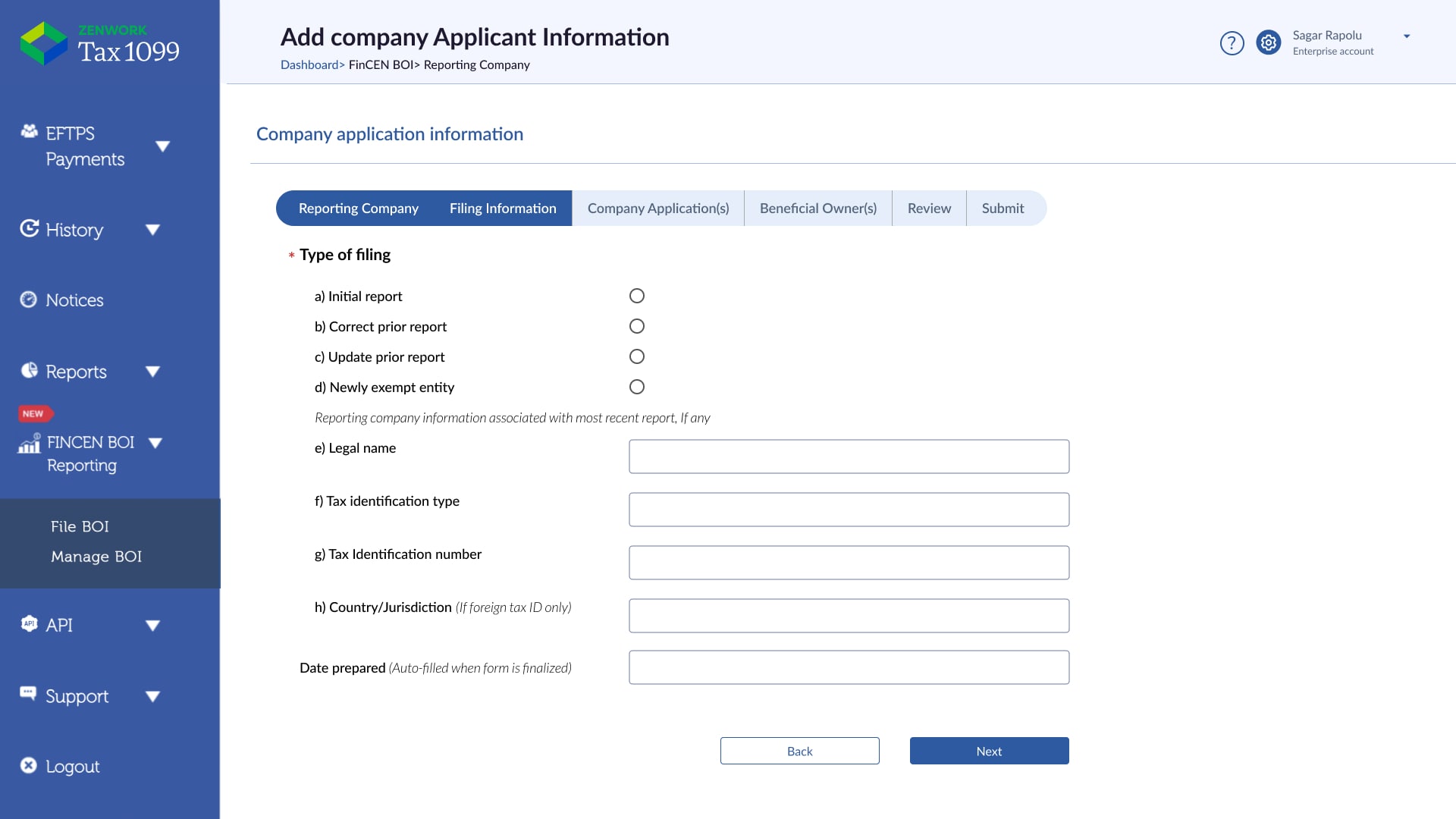

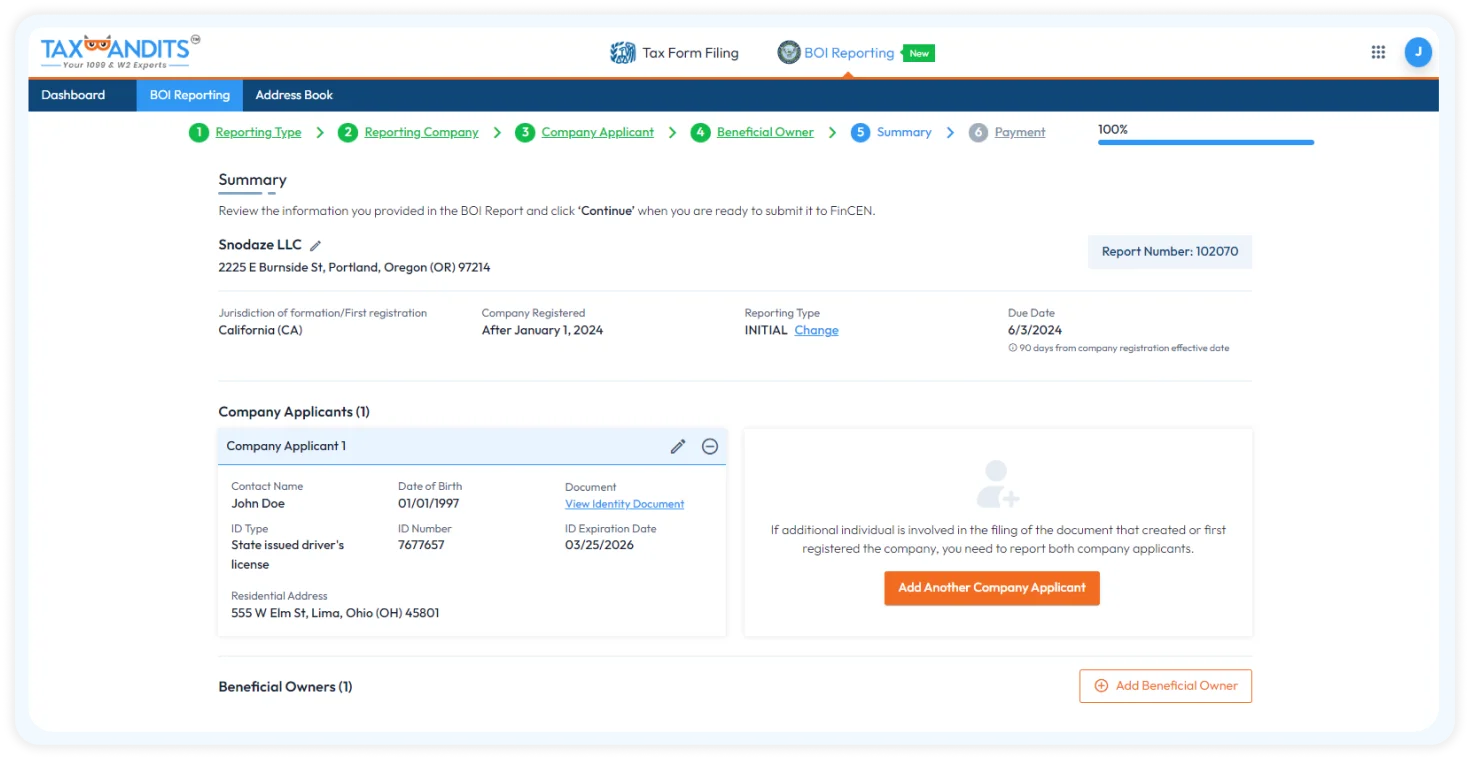

BOI Filing How to File BOI Report Online for 2025, Beneficial ownership information frequently asked questions.

A Closer Look at BOI Reporting in 2025 GreenGrowth CPAs, Starting january 1, 2025, many businesses must file a boi report with fincen.

A Closer Look at BOI Reporting in 2025 GreenGrowth CPAs, Entities that are registered to do business in the united states are potentially impacted by.

File BOI Reporting Online How to file BOI Report 2025 Tax1099, Provides interactive checklists, infographics, and other tools to assist businesses in complying with the boi reporting rule.

BOI Filing How to File BOI Report Online for 2025, Beginning january 1, 2025, the federal corporate transparency act (cta) requires certain types of entities to file a beneficial ownership information (boi) report with the financial crimes enforcement network (fincen), a bureau of the united states department of treasury.

File BOI Report Online for 2025 BOI Filing, As the filing deadline draws closer, the aicpa has grave concerns about the current financial crimes enforcement network (fincen) beneficial ownership.

Demystifying new BOI Reporting for 2025 A NoSweat Guide for Business Owners — The Freelance CFO, Starting in 2025, registered businesses must report information about their owners to fincen.

BOI 2025 Essential Tax Reporting Guide for Small Business Owners, Boi reporting to fincen is critically important, and we can do this work for you for a minimal flat fee, no matter what state you live in.

December 18, 2025 KDP Certified Public Accountants, LLP, If your company is created or registered on or after january 1, 2025, you must report boi within 30 days of notice of creation or registration.