Income Tax In Michigan 2025

Income Tax In Michigan 2025. Michigan pension and retirement payments withholding. Welcome to the 2025 income tax calculator for michigan which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

The state’s i ncome tax has decreased from 4.25 percent to 4.05 percent for 2025. The median household income across all 345 cities is $77,345, making.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, March 7, 2025 cpas & advisors. The michigan department of treasury feb.

Mi 1040x Fill out & sign online DocHub, The michigan tax calculator is updated for the 2025/25 tax year. The lowering mi costs plan (public act 4 of 2025) was signed into law on march 7, 2025, and will amend michigan’s current income tax act to provide a substantial tax deduction.

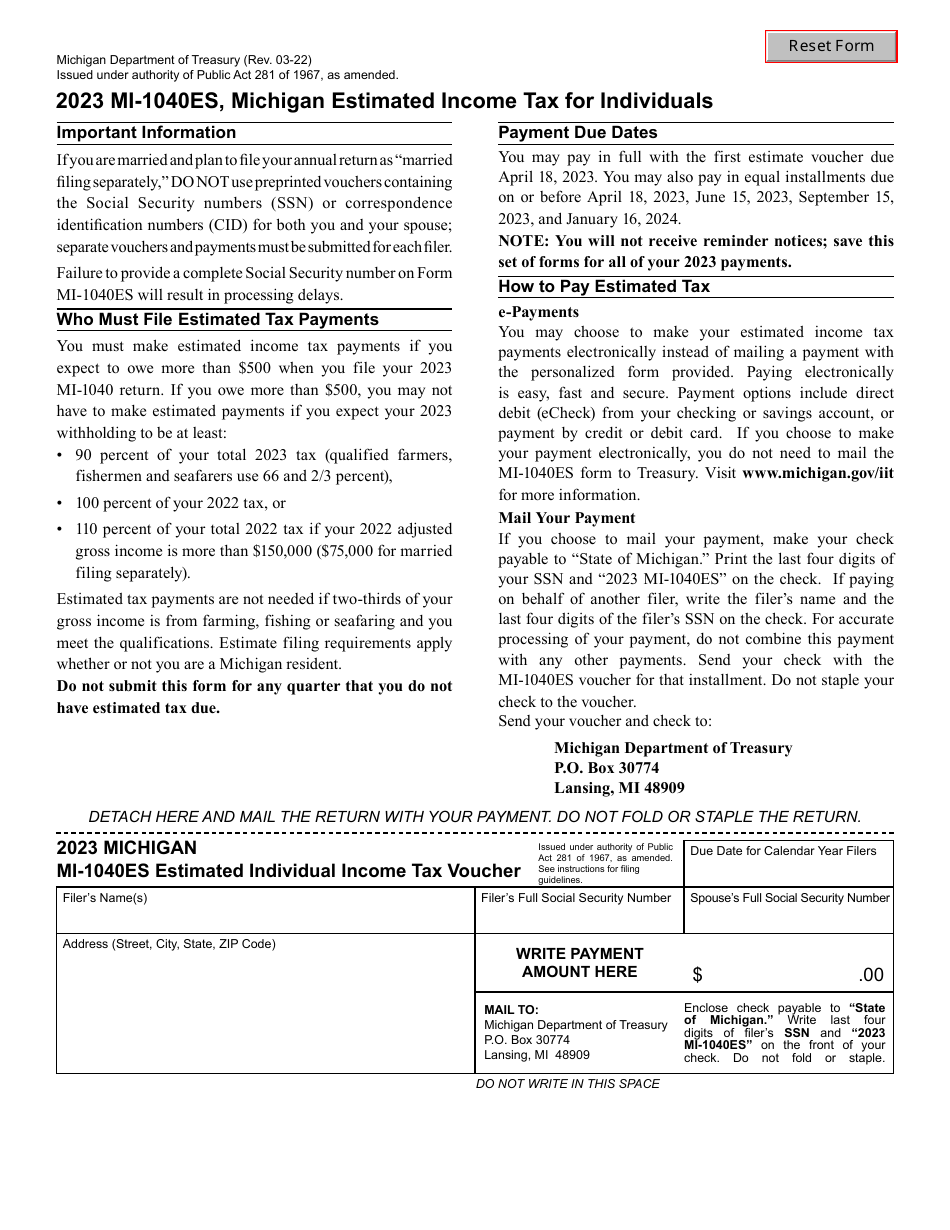

Form MI1040ES Download Fillable PDF or Fill Online Estimated, There is no fee to use this payment option. Welcome to the 2025 income tax calculator for michigan which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your.

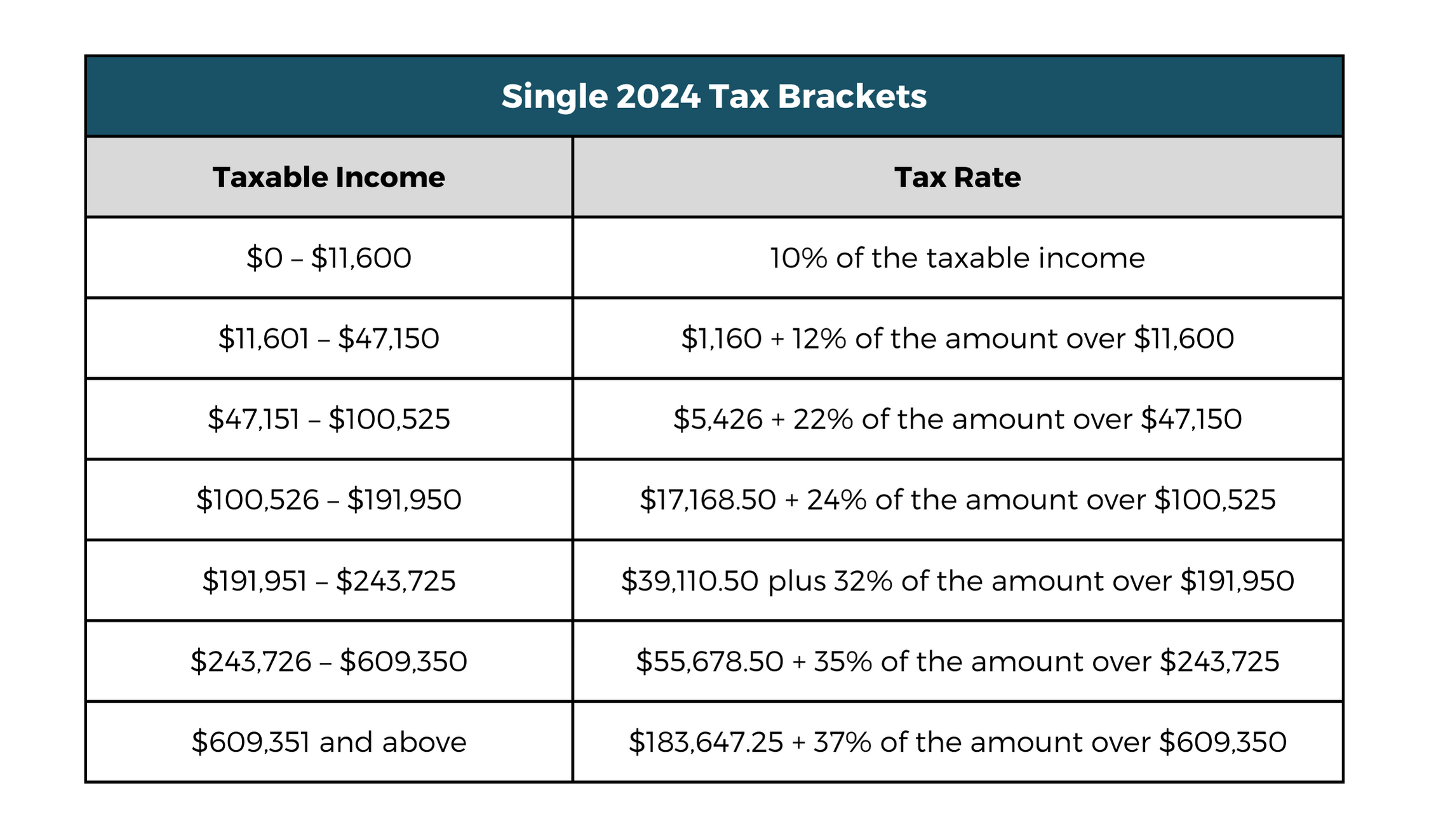

2025 Tax Brackets Mfj Limits Brook Collete, The flat income tax rate on state of michigan returns was 4.25% in 2025. 2025 michigan income tax withholding guide:

State Corporate Tax Rates and Brackets Tax Foundation, The michigan tax calculator is updated for the 2025/25 tax year. Individuals and fiduciaries subject to tax under part 1 of the income tax act, mcl 206.1 et seq., are subject to tax at the rate provided under section.

Tax rates for the 2025 year of assessment Just One Lap, 2025 estimated individual income tax voucher: The michigan department of treasury feb.

Highlights of IRS data from Michigan tax returns, Individuals and fiduciaries subject to tax under part 1 of the income tax act, mcl 206.1 et seq., are subject to tax at the rate provided under section. 2025 sales, use and withholding taxes annual.

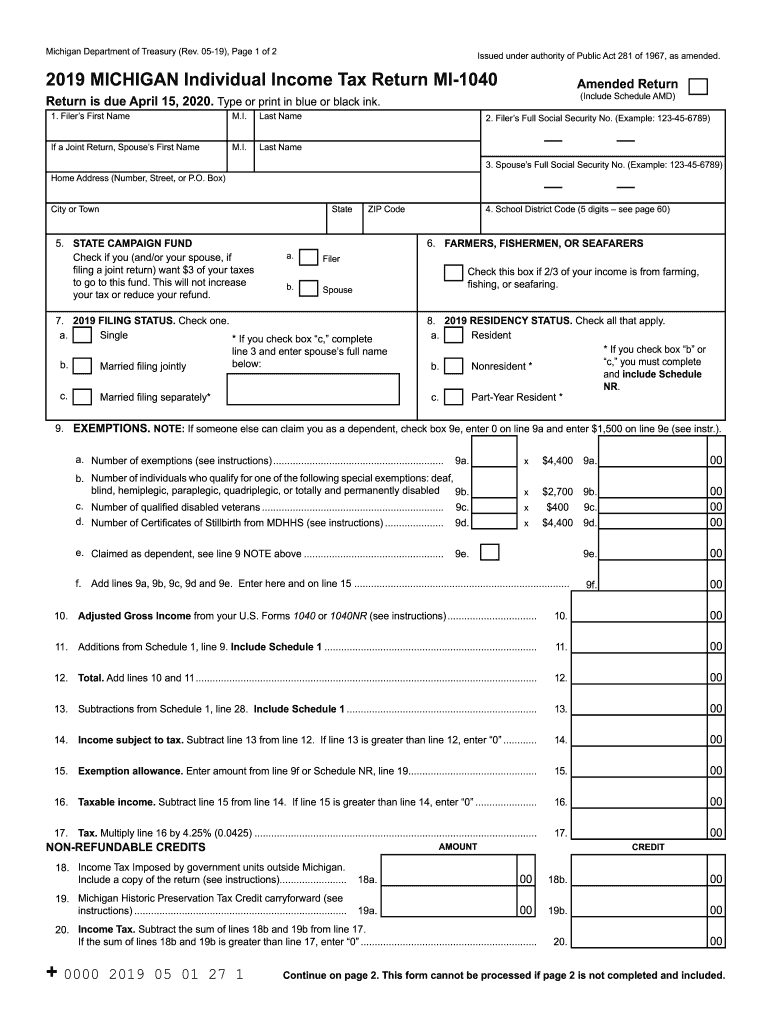

Mi 1040 20192024 Form Fill Out and Sign Printable PDF Template signNow, The flat income tax rate on state of michigan returns was 4.25% in 2025. And it will be down to 4.05% in 2025.

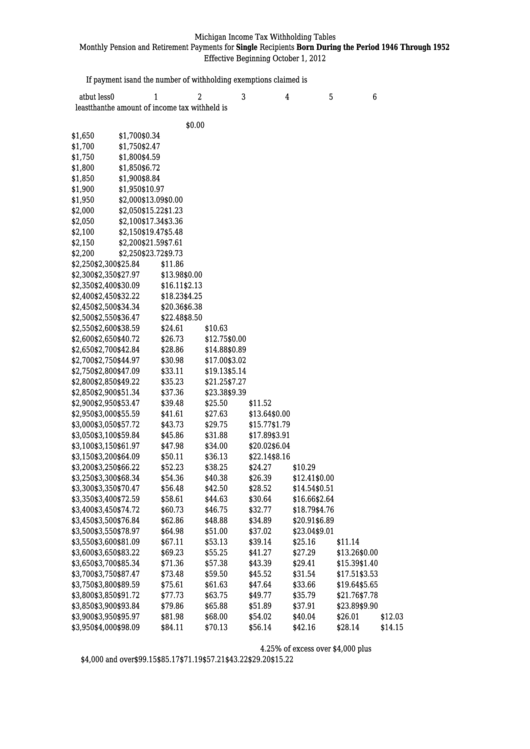

Michigan Tax Withholding Tables printable pdf download, Michigan income tax rate returns to 4.25% in the 2025 tax year. The state’s i ncome tax has decreased from 4.25 percent to 4.05 percent for 2025.

Highlights of IRS data from Michigan tax returns, 2025 sales, use and withholding taxes annual. Michigan has a flat income tax of 4.25% — all earnings are taxed at the same rate, regardless of total income level.